Earned Income Tax Credit will benefit more than 17 million

More people than ever before will qualify for significant new tax benefits this year. The Earned Income Tax Credit (EITC), which was temporarily expanded in the 2021 American Rescue Plan, will benefit more than 17 million workers in the United States. The EITC is designed to increase earnings for workers with low to moderate incomes. Greater income increases workers’ ability to cover essential needs such as housing, food, and health care.

For the first time, adults who work and aren’t raising children at home could qualify for an income boost of up to $1,502. The newly eligible population includes workers aged 19-24 and 65 and older. Workers aged 19-23 who attended school at least half time for at least five months in 2021 do not qualify. Homeless youth and former foster youth who are at least 18 years old and who work are eligible to claim the EITC, even if they are enrolled in school. To qualify, workers must earn less than $21,430 if single or less than $27,380 if married.

The IRS estimates that roughly 35 percent of eligible workers not raising children miss out on the EITC — likely because they are unaware they qualify. This results in millions of dollars of unclaimed benefits. With the federal expansion, this number could rise.

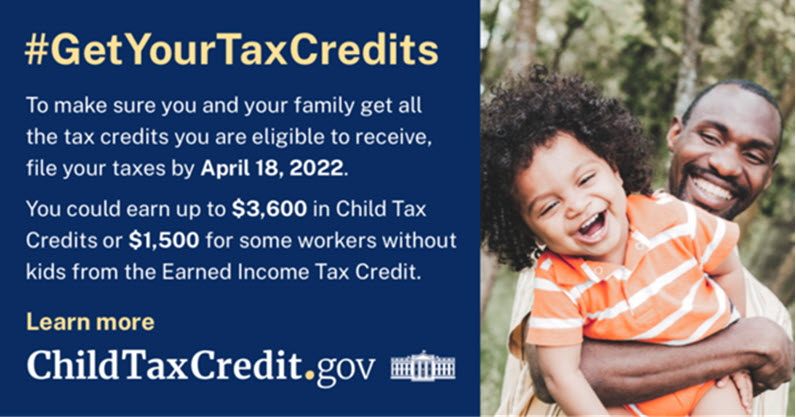

Workers newly eligible for the expanded EITC. Those who were eligible for a very small credit in the past and may not know that the credit value has tripled, and people who may have missed out on other tax benefits, such as the third round of economic stimulus payments. Eligible workers can get help filling out their tax return through April 18, 2022, using GetYourRefund.org, developed by the nonprofit Code for America. This site provides options for virtual, in-person, and do-it-yourself tax filing.